If renewed, the levy would continue local funding for school operations at the current tax rate

Residents of Eugene School District 4J will vote May 21 on whether to renew the 4J local option levy for five years. If approved, the levy would continue to provide an estimated $17 to $19 million per year to fund 4J school operations and maintain the current tax rate.

Measure 20–301, if approved, would:

- Renew the local option levy for school operations

- Continue the current tax rate for the local option levy

- Provide about $17–19 million each year to fund school operations

- Fund the equivalent of about 161 teachers or 27 school days each year

Registered voters in 4J can vote on the levy renewal:

- You must live in Eugene School District 4J to vote on this measure

- Voter registration deadline is April 30 (Register online)

- Ballots mailed in early May, due by May 21 at 8 p.m.

What is the local option levy?

The Eugene School District 4J local option levy is a property tax that provides money for school operations in 4J schools and charter schools.

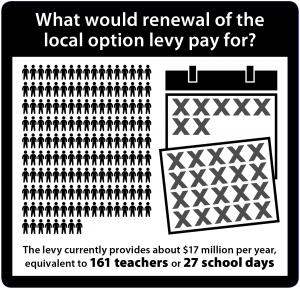

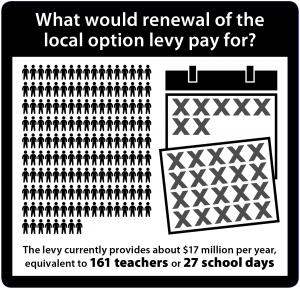

The levy currently provides about $17 million per year, 9 percent of the school district’s operating budget. This is equivalent to about 161 teaching positions or 27 school days.

This is not a new tax or a tax increase. The 4J local option levy has been in place since 2000, approved by voters four times. The current levy expires in 2020. If passed, Measure 20-301 would renew the levy at the same tax rate for five years, through June 2025.

How is the local option levy different from a capital bond, like 4J voters passed last year?

Local option levies pay for school operations: staff, class sizes, programs, utilities and other daily operating costs. By law, bond funds can be spent only on capital improvements such as buildings, buses and technology.

Under Oregon property tax law, a local option levy is the only tool a school district has to allow the community to increase funding for local school operations.

What would it cost property owners?

If Measure 20-301 is approved, property owners would continue to pay about the same amount as they do now. Renewing the levy would continue the current property tax rate for the 4J local option levy.

Due to Oregon’s property tax limits, owners of each property pay a different amount, depending on the difference between the assessed value and the real market value. The maximum rate for the local option levy is $1.50 per $1,000 assessed value. Most taxpayers pay less than the full rate. The average rate in property owners’ 2017–18 tax bills was $1.01 per $1,000 assessed value.

To see how much you currently pay, check your 2018 property tax statement (look up your property by name or address, go to the property record, then click “View Current Tax Statement” at left), and look under “Current Tax By District” for “Eugene School District Local Option.” Or, to estimate your tax if you know your approximate assessed value and real market value, use this online levy calculator. Changes in your property’s real market value or assessed value may affect the amount of your taxes.

What would the levy renewal pay for?

The local option levy has allowed 4J schools to maintain a level of educational opportunities that would not be possible if state funding levels were the district’s sole source of revenue. 100% of levy proceeds stay in the Eugene School District to fund public school operations. The district provides a portion of levy revenues to public charter schools.

If renewed, the levy would continue school funding equivalent to about 161 teachers or 27 school days each year. It would help maintain class sizes and school programs supported by the current levy.

What if the levy renewal doesn’t pass?

If Measure 20-301 is not approved by voters, the school board could decide to submit another levy renewal proposal to voters in the fall, while preparing a plan to reduce staffing and operations by about 9 percent if that measure failed. The school board would hold public hearings before deciding how to reduce the budget.

If the levy were not renewed before the current levy’s expiration in June 2020, the local option levy property tax rate would not be assessed, and the school district’s annual operating budget would be reduced by about $17.7 million starting in the 2020–21 school year.

What’s next?

To be eligible to vote on the 4J local option levy, you must live in the Eugene School District and be registered to vote by April 30.

Ballots will be mailed to voters beginning May 1. Completed ballots must be returned to Lane County Elections or a ballot drop box by 8 p.m. on Tuesday, May 21, 2019.

Who can vote on this measure:

Eugene School District 4J residents

Voter registration deadline:

April 30 (register online)

Ballots mailed:

May 1–7

Ballots due to Lane County Elections or a ballot drop box:

May 21, 8 p.m.

Learn more:

4J Communications Office, 541-790-7734

Info sheet to print or share (PDF):

Measure 20-301 Information Sheet

Información en español

Proyecto de Ley 20-301

This information, except for website links, was reviewed by the Oregon Secretary of State’s Office for compliance with ORS 260.432. (SH 19-071)

Additional settings for Safari Browser.

Additional settings for Safari Browser.